Definition of ”resident”or”non-resident”

| Resident | Non-resident | |

| Japanese | (1)Those who live in Japan (2)Those who work at diplomatic establishments in Japan |

(1) Those who left Japan to work at an office in a foreign country and live (2) Those who left Japan to live in foreign country for two or more years (3) Those who go to a foreign country and stay therein for two or more years (4) Those who meet any of (1) to (3) above, return to Japan temporarily, and stay for less than six months Foreigner |

| Foreigner | (1)Those who work at an office in Japan (2)Those who come to Japan and stay for six or more months |

(1)Those who live overseas (2) Those who provide public service in a foreign government or international organ (3)Diplomatic officials or attendants/employees who work at a consulate(limited to those who are appointed or employed overseas) |

| Corporation | (1) Domestic companies based in Japan (2) Branches, agencies, or other offices of a foreign company in Japan (3) Foreign diplomatic offices in Japan |

(1) Foreign companies based in a foreign country (2) Foreign branches, agencies, or other offices of a Japanese corporation (3) Foreign governments’ offices or international organizations in Japan |

Note:Regardless of the classification above, the US Armed Forces, UN Forces, and constituent members thereof are non-residents.

Definition of ”resident”or”non-resident”

Extracted from the material ” Guidance for the Control of Sensitive Technologies for Security Export for Academic and Research Institutions (4th Edition)”,METI,METI, p.30,22.Sep.2022

1. Provision of regulated technology from residents to non-residents.

・A transaction with the aim of providing regulated technology from residents to non-residents (refer to the above table).

2. Provision of regulated technology with the aim of providing it abroad.

3. Provision of regulated technology from residents to individuals falling under specific categories.

If you intend to engage in a transaction with the purpose of providing regulated technology to individuals falling under specific categories, prior approval from the Ministry of Economy, Trade and Industry is required.

Regarding Individuals Falling Under Specific Categories

Reference on the ”Specific Categories”

1. (METI) (Sheet#4, 「Regulations of Deemed Export Controls」

2. Leaflet 「Please check your status without fail. Do you fall under one of the specific categories?」

Q&A on Specific Categories

| Q | A |

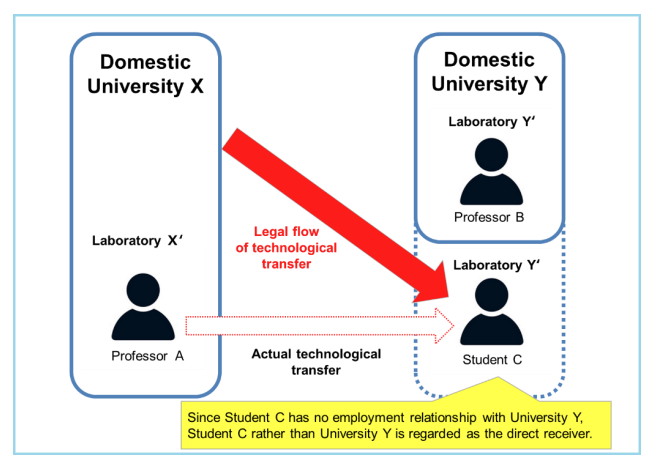

| In the case of joint research between Domestic University X and Domestic University Y, how should the confirmation of individuals falling under specific categories be conducted? |

In joint research between domestic universities, it is necessary to confirm whether students participating in the joint research fall under specific categories. Please refer to the diagram below. In the scenario where Professor B and Student C at Domestic University Y are both individuals falling under specific categories:

1. Technology transfer from Domestic University X to Domestic University Y

2. Technology transfer from Domestic University Y to Professor B (individual falling under specific categories)

For both cases, they are typically considered not to qualify as ‘transactions,’ and therefore, they are exempt from the regulations of the Foreign Exchange and Foreign Trade Act. Domestic University X does not need to confirm the specific category status of Professor B, who receives technology from Domestic University Y.

However, in the case of:

3. Technology transfer from Domestic University X to Student C

If Student C falls under specific categories, considering Student C as part of Domestic University Y may not be appropriate since Student C is not employed by Domestic University Y. In this case, Domestic University X needs to confirm the possibility of Student C falling under specific categories and apply for permission for technology transfer from Professor A at Domestic University X to Student C at Domestic University Y.

|

|

|

| If an employee newly falls under a specific type, how should we handle it? We anticipate that you will need to apply for permission if you plan to provide regulated technologies under the Foreign Exchange and Foreign Trade Act to the employee in question. Does providing technology to a resident falling under a specific type fall under the scope of catch-all regulations? | It is applicable. If providing technology from resident A to resident B falls under the 16th item of the Foreign Exchange Order, and resident B is influenced by non-resident C (meaning, resident B falls under a specific type), permission is required if the use of the technology by non-resident C meets the criteria for catch-all regulations. |

| Professor A at our domestic university, University X, also holds a professorship at the foreign University Y. Does Professor A fall under Specific Type ①? |

Unless exempted by the exception provisions (i) or (ii) of Specific Type ①, it generally falls under Specific Type ①. The exception provisions (i) or (ii) can be briefly explained as follows:

(i) When it is agreed that instructions or commands towards Professor A take precedence at our domestic University X over the foreign University Y. (ii) While not commonly applicable in the university context, for general business cases, it applies when an individual employed by a domestic company has employment contracts or agreements with overseas subsidiaries (where Japanese capital, directly or indirectly, constitutes 50% or more). |

| Does the term ‘having earned substantial economic benefits’ in Specific Type ② include individuals who have earned such benefits in the past? |

As a general rule, it does not. However, if an individual has received benefits in the past, such as loans or other forms of assistance, from a foreign government, and currently holds an obligation or a debt to that foreign government, which has reached its maturity or has no specified maturity date, it is considered that the individual has gained the benefit of not enforcing the claim for debt repayment.

|

| No, it does not. In this case, where Professor A of University X receives research funding from a foreign government, the use of funds is restricted to research expenses and cannot be allocated to personnel expenses, including the recipient himself. Therefore, the research funding in question does not fall under the category of ‘substantial economic benefit’ in Specific Type ②. |

If it falls under the management of the university’s financial management, and the received funds do not contribute to the individual income of the recipient (i.e., Professor A), but rather become the income of University X or the affiliated research laboratory, it does not qualify as Specific Type ②.

On the other hand, if it contributes to the individual income of the recipient (i.e., Professor A), then it qualifies. When receiving non-monetary benefits, how should such benefits be converted into monetary value? When receiving non-monetary benefits from a foreign government, etc., the determination is made by converting the benefits into monetary value, and assessing whether these benefits constitute 25% or more of the annual income. The conversion into monetary value should be conducted using methods commonly accepted in ordinary commercial practices.

|